What is Por Ngor Dor 1?

Withholding tax at source under Section 59 for remuneration paid to employees under Section 40(1), (2)

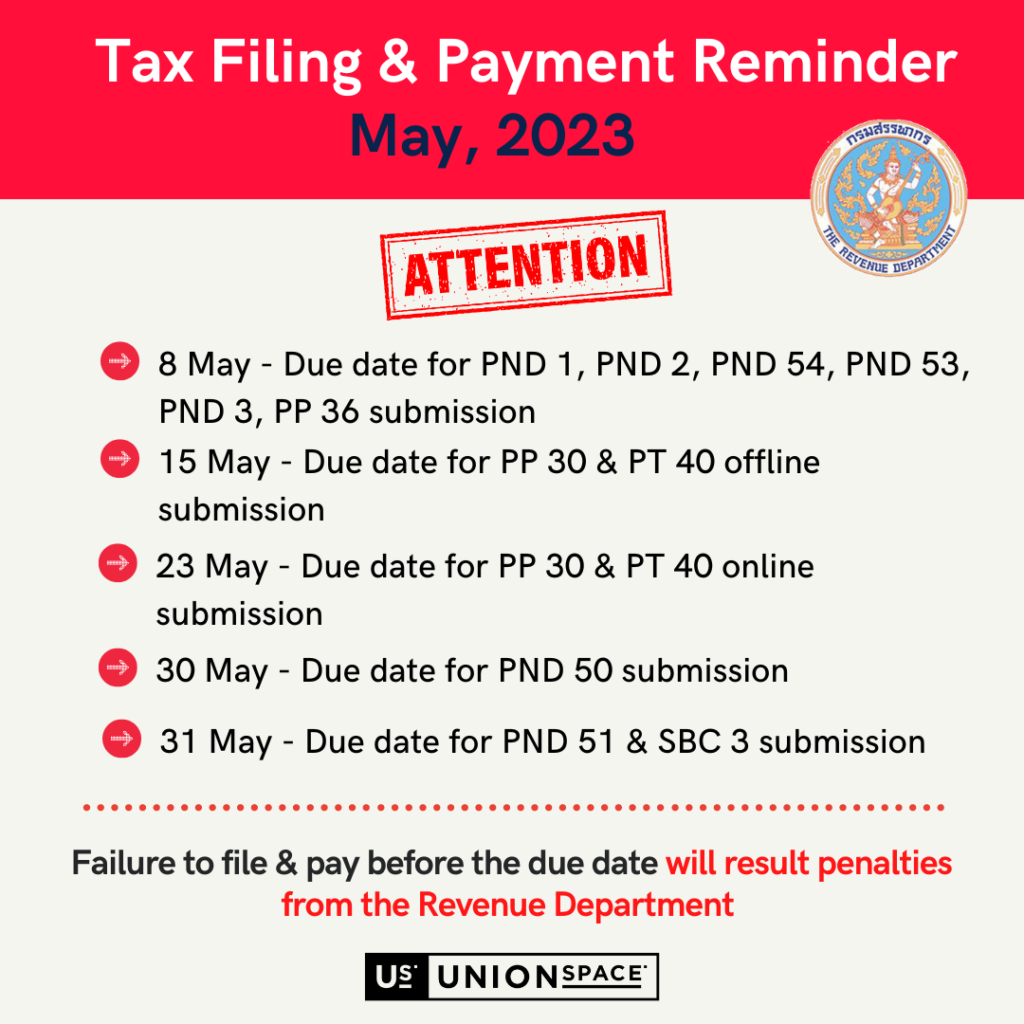

Instructions/Comments: Employers must withhold tax on remuneration paid to employees in April 2023 and remit the tax so withheld to the District Office.

What is Por Ngor Dor 2?

Income tax withheld at source under Section 59 for income paid to individual under Section 40(3), (4)

Instructions/Comments: The payer of such income in April 2023 must remit the tax withheld to the District Office.

What is Por Ngor Dor 54?

Withholding tax on payment on income under Section 40(2) – (6) made to foreign companies under Section 70

Instructions/Comments: The payer of such income in April 2023 must remit the tax withheld to the District Office.

What is Por Ngor Dor 53 (withheld from companies) and/or Por Ngor Dor 3 (withheld from individuals)?

Withhold tax under Section 3 tredecim

Instructions/Comments: In relation to the payment of such income (as discussed in paragraph 6 of the Guidelines) made in April 2023, the payer must remit the tax so withheld to the District Office.

What is Por Por 36?

Value Added Tax return (for input VAT on imported goods or services and for non-resident operators under Section 83/6)

Instructions/Comments: The importer of goods or services who remits payment in April 2023 to non-resident operators is responsible for remitting the input VAT (self-assessment) to the District Office.

What is Por Por 30?

Value Added Tax return under Section 83

Instructions/Comments: A VAT registrant must file with the District Office a return entailing output VAT and input VAT incurred in April 2023 and accordingly: (i) remit net output VAT; (ii) carry forward excess input VAT to the next month; or (iii) claim a refund for excess input VAT.

What is Por Tor 40?

Specific Business Tax return under Section 91/10

Instructions/Comments: A Specific Business Tax registrant (operating the businesses of banking, finance, securities, credit foncier, life insurance, pawnbroking, regular transactions similar to commercial banking) must submit this return and pay any tax due on its gross revenue for April 2023 to the District Office.

What is Por Ngor Dor 50?

Annual corporate income tax return under Section 68

Instructions/Comments: A limited company with an accounting period ending December 31, 2022 must file this return with the audited financial statements and pay any tax due to the District Office.

What is TP Disclosure Form?

The Notification of Director-General of TRD on Official Transfer Pricing (“TP”) Form Paragraph 1 of Section 71 ter of the Thai Revenue Code

Instructions/Comments: A Company or juristic partnership who has a relationship with another juristic person(s) according to Section 71Bis of Thai Revenue Code and has annual income of 200 million Baht or more is required to submit Disclosure form along with the Por Ngor Dor 50.

What is Por Ngor Dor 51?

Mid-year corporate income tax return

Instructions/Comments: A limited company with an accounting period commencing October 1, 2022, must file the return and pay one-half of any tax due on the estimated annual profit, or the tax due on the actual first 6 months profit, as the case may be, to the District Office.

What is Sor Bor Chor 3?

Audited financial statements and list of shareholders as of the date of annual general meeting of shareholders.

Instructions/Comments: A limited company with an accounting period ending December 31, 2022 and having its audited financial statements approved by the annual general meeting of shareholders on April 30, 2023, must submit such financial statements to the Company Registrar’s Office, Department of Business Development, within one month from the date of such approval.

Thai tax laws can be quite daunting to the unfamiliar and failure to file or pay by the due date will result immediate penalty with no grace period. It may be more efficient to outsource your monthly bookkeeping and tax filing and if you are considering one, check out https://unionspace.co.th/thailand-accounting-tax-bookkeeping-service.php

Accounting and tax reporting service starts from THB3,000 per month only. Alternatively send us a message on Line: https://lin.ee/QUvqnS