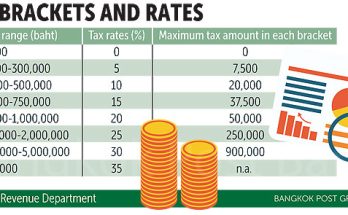

Tax Filing & Payment Reminder for SMEs for May, 2023 in Thailand

What is Por Ngor Dor 1? Withholding tax at source under Section 59 for remuneration paid to employees under Section 40(1), (2) Instructions/Comments: Employers must withhold tax on remuneration paid to …

Tax Filing & Payment Reminder for SMEs for May, 2023 in Thailand Read More