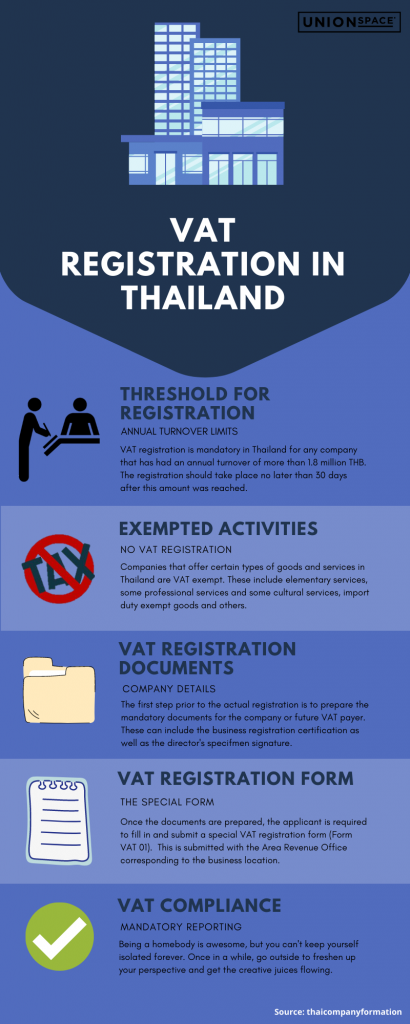

Threshold for registration

VAT registration is mandatory in Thailand for any company that has had an annual turnover of more than 1.8 million THB. The registration should take place no later than 30 days after this amount was reached.

Exempted Activities

Companies that offer certain types of goods and services in Thailand are VAT exempt. These include elementary services, some professional services, and some cultural services, import duty exempt goods, and others.

VAT Registration Documents

The first step prior to the actual registration is to prepare the mandatory documents for the company or future VAT payer. These can include the business registration certification as well as the director’s specifmen signature.

VAT Registration form

Once the documents are prepared, the applicant is required to fill in and submit a special VAT registration form (Form VAT 01). This is submitted with the Area Revenue Office corresponding to the business location.

VAT Compliance

Being a homebody is awesome, but you can’t keep yourself isolated forever. Once in awhile, go outside to freshen up your perspective and get the creative juices flowing.