All tax residents in Thailand must file for a Personal Income Tax Return (PND 90 or 91) every year. The deadline to file and pay for Personal Income Tax is on 31 March of the following year. If you’re a foreigner, you must obtain a Tax Clearance Certificate before leaving Thailand and you are required to submit this document to the immigration officer on exit.

Types of taxable income in Thailand

Assessable income in Thailand is categorised into eight categories:

1) Income from employment, including wages, salary, bonus, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, payment of debt liability of an employee made by an employer, or any money, property or benefit derived from employment

2) Income from the hire of work, office of employment or services

3) Income from goodwill, copyright, franchise, patent or other rights

4) Income from interest, dividend, bonus for investors, gain on amalgamation, acquisition or dissolution of a company or partnership or gain on transfer of shares

5) Lease of property, breach of a hire-purchase agreement and instalment sale contract

6) Income from liberal professions, such as law, medicine, engineering, architecture, accountancy and fine arts

7) Income from a contract of work whereby the contractor provides essential materials other than tools

8) Income from business, commerce, agriculture, transportation or any other activity not mentioned above

As specified in #4, capital gains are taxable as ordinary income.

There are 3 exceptions to the taxability of the capital gains:

- Income from wages and salary, including the benefits provided by an employer (e.g. income from stock options, personal income tax paid and absorbed by the employer, living allowances, monetary value of rent-free accommodation…), but excluding business travel expenses and medical treatment

- Capital gains on the sale of non-interest bearing government bonds or debt instruments (although there are exceptions)

- Capital gains on the sale of government bonds

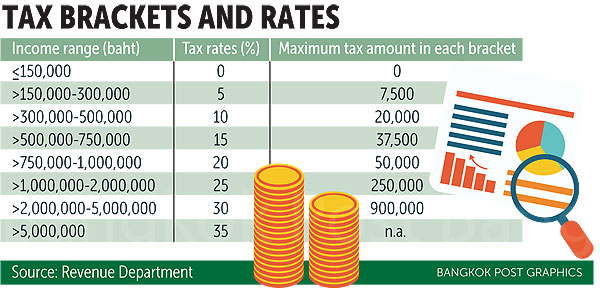

Personal income tax rates in Thailand 2023

Thailand employs a progressive tax system for personal income tax, the rates of which are as follows:

| Taxable income (THB) | Tax rate |

| 0 – 150,000 | Exempted |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1 million | 20% |

| 1,000,001 – 2 million | 25% |

| 2,000,001 – 5 million | 30% |

| 5,000,001 or more | 35% |

Available deductions and allowances

Taxpayers can deduct the standard amount or actual expenses from the income received as follows:

| Income type | Deductible expenses |

| Employment income (1) | 50% of the assessable income capped at THB 100,000 |

| Income from hiring of services (2) | 50% of the assessable income capped at THB 100,000 |

| Income from goodwill, copyright and other rights (3) | 50% of the assessable income capped at THB 100,000 or the actual expenses |

| Income from interest, dividend (4) | Expenses cannot be deducted |

| Rental income (5) | 10 – 30% of income or actual expenses |

| Income from liberal professions (6) | 30 – 60% of income or actual expenses |

| Construction income (7) | 60% of income or actual expenses |

| Income from business, commerce, agriculture, transportation or other income (8) | 60% of income or actual expenses |

Resident taxpayers can deduct personal and specific allowances in accordance with the table below:

| Allowances | Baht (THB) |

| Personal allowances | |

| Personal allowances for taxpayers | 60,000 |

| Spouse allowance | 60,000 |

| Child allowance (maximum of three children each) | 30,000 per child |

| Parent allowance | 30,000 per parent (ages over 60) |

| Maternity and pregnancy allowance | Actual payment but not exceeding 60,000 |

| Care of disabled or incapacitated family member | 60,000 each |

| Care of a disabled or an incapacitated person other than a family member | 60,000 |

| Special allowances | |

| Social security fund contributions | Maximum of 9,000 per year |

| Life insurance premium | Not more than 100,000 per year |

| Health insurance premium | Not exceeding 15,000 per year (when combined with life insurance premium does not exceed 100,000) |

| Health insurance premium for parents | Not exceeding 15,000 |

| Mortgage interest incurred for the purpose of purchase or construction of a residential building in Thailand | Maximum of 100,000 per year |

| Contributions to the Provident Fund | Contributions with a limit of 15% of total wages but not exceeding an allowance of 500,000 |

| Contributions to the Retirement Mutual Fund | Contributions with a limit of 15% of total assessable income subject to tax with a maximum allowance of 500,000 |

| Donations to specific charities | Actual donated amount up to 10% of taxable income after all other allowances are deducted |

It is crucial that every Thailand Tax Resident file and pay for their Personal Tax within the deadline as failure to do so may result in heavy penalties and imprisonment. Special note for foreigners: The Revenue Department and the Immigration system are linked and you may be detained at the immigration if you have a long outstanding tax payment.

Contact UnionSPACE Accounting & Tax Team if you have any concerns or require assistance to obtain a Tax Clearance Certificate.

Email: sales@unionspace.co.th

Phone: +662 036 0600

Line: @unionspaceth

WhatsApp: +66620155533